HOW BAD IS IT?

With new lenders and brokers opening their doors every day and more capital available in the market for small businesses than ever before, the fight for the lowest rate is a cut-throat battle. The desperation to gain market share while continuing to make a profit has led some lenders and brokers to add unnecessary “fees,” which allows them to post a lower rate than the competition to earn business despite charging more. Fees may be disclosed and defined or they could be included within a blended, lump sum cost in the agreement, which is extremely confusing for you.

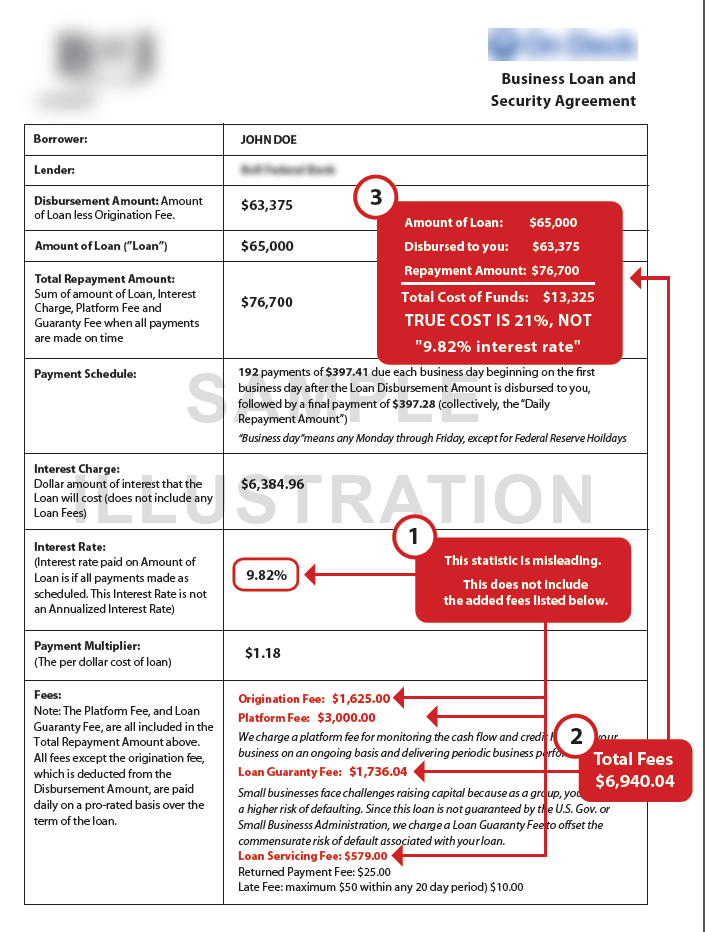

Here is an example of a competitor agreement and our breakdown of the real cost:

HOW IS THIS LEGAL?

Brokers and lenders often blend fees and have no cap on the amount of extra fees they can add to the final cost. At The Business Backer, we have even received competitor funding agreements with fees that are entirely fabricated with no tie back to actual services. Without knowing what to look for or what to ask, you could be paying thousands of dollars in unnecessary fees. For information on the self-regulation movement in the small business lending industry, check out Jim Salters’, CEO of The Business Backer, recent guest blog post for LendIt.

WHAT ARE THESE FEES?

Fees can have many different names and definitions depending on the broker or lender. Here are the common ones we see:

- Origination Fees – Charged for processing a new loan.

- Platform Fees – Some lenders claim this fee is for “monitoring credit and cash flow of the business.” Most definitions of this fee are vague and (purposefully) unclear.

- Loan Guaranty Fees – Charged to protect the broker or lender from default. As of October 2013, the SBA does not require these fees for their loans under $150,000.

- Loan Servicing/Packaging Fees – Covers administration costs to service the loan from disbursement to pay off.

- ACH/Wire Transfer Fees – Charged to send the capital directly to the client’s bank account.

- Broker Fees – Commission fees provided to the loan broker. While fees can be as low as 1%, we’ve seen fees as high as 20% of the total loan amount. These fees are often embedded into the payment multiplier section of the contract and difficult to see.

- Closing Costs – Could include a variety of different fees to service the loan and can vary based on the lender. Typically 1 – 2% of the total loan.

WHAT CAN YOU DO?

Remember that the lowest rate may not be what it seems. Doing the math in order to understand the total cost of the loan with these additional fees allows for a better apples-to-apples comparison when deciding on a funding partner.

Don’t be afraid to ask questions. If you are unsure about a fee, you should always ask. Good lenders and brokers provide complete transparency about their offers and are more than happy to answer any questions.

Get another opinion before making a decision. Whether it comes from friends, family, or a trusted advisor like your CPA or attorney, getting feedback from an outside source can help you see your offers from a different perspective and identify questions you may have missed.

[mk_image src=”https://live-the-business-backer.pantheonsite.io/wp-content/uploads/2015/04/efin2280_hi.jpg” crop=”false”]